Plussios provides you with a Google.Sheets document template that provides everything you’ll need to plan and control your money. This includes: budget overview, entering incomes and expenses, and assigning money. In the full version of the template, there’s also accounts and a separate place for account reconciliation. We’ll go over each of the features below.

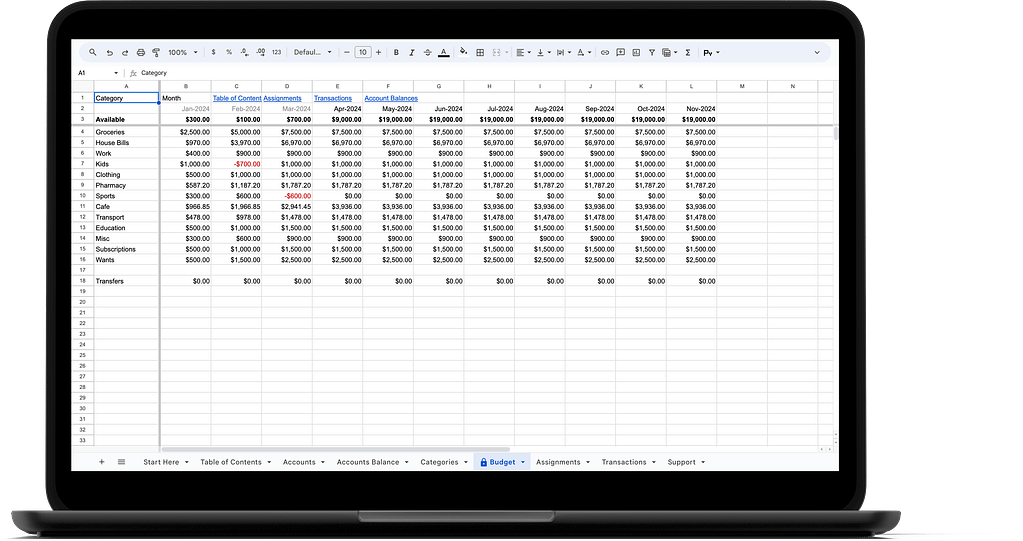

Budget Sheet

The Budget sheet contains the main information about your budget. How much funding is left for each category this month? What amount is available to assign to categories? You’ll find answers to these questions on the Budget Sheet.

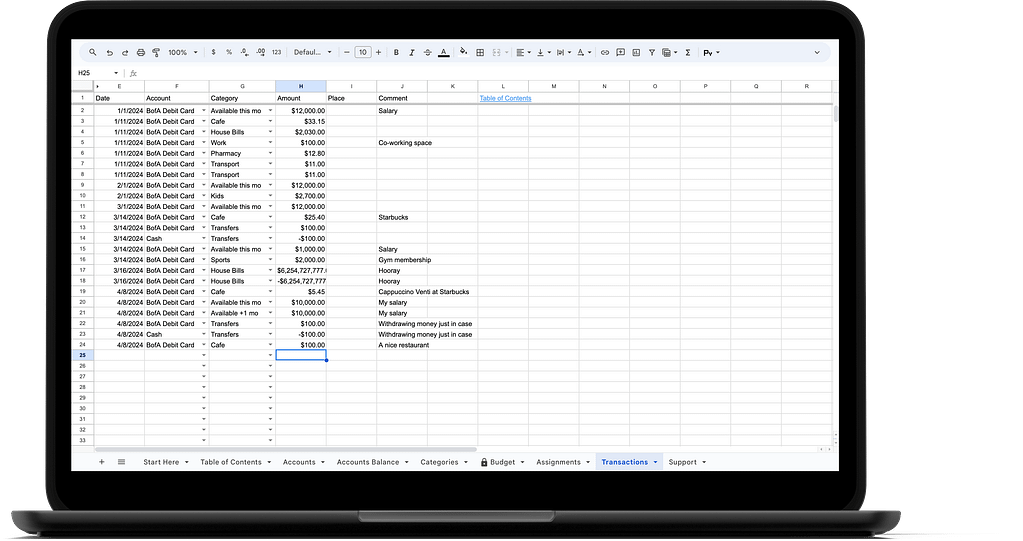

Transactions Sheet

You track all of your income and expenses on the Transactions sheet. To record a purchase, you enter its date, category, and amount. You can also write an optional comment. For income, you also enter the date, amount, and optional comment. Instead of category though, you choose when the new money is available—this month, or the next month. In both cases, if you use the full version of the template, you also select the account from which you paid or where money landed.

Assignments Sheet

On the Assignments sheet, you fund each category with money available from your income. Your expenses should stay within the assigned amounts, and when they go beyond that, you move the funds from another category to cover this overspending.

Two Versions

We provide you with two versions of the template, which we call Finance Buddy and Family Pro. The Finance Buddy version allows you to do as much as Family Pro but for dealing with accounts. The Finance Buddy version doesn’t care where you store your physical or digital money—in a wallet, on bank accounts, under the pillow. The Family Pro version lets you keep track of such money holders, and reconcile your budget in a more exact manner.

The document is yours to modify

Because it is a plain Google.Sheets document, you are free to make any changes you want. You can see how your taxi expenses changed over time by adding a pivot table with some filters. You may want to add your long-term financial plan and track your progress in the same place. Whatever your needs are, the document is there to meet them.